This post outlines what is included in the Cost of Goods Sold (COGS) calculation, specifically for SaaS or software companies. There has been a lot of confusion surrounding COGS for SaaS, so I try and simplify it here.

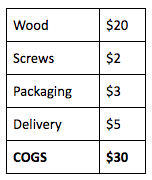

Cost of Goods Sold (COGS) refers to the direct costs associated with selling, packaging and delivering your product. In a traditional sense, this is very simple to calculate. For example, if you’re selling a chair, you would add the materials to manufacture the chair, packaging, and delivery costs to calculate your COGS.

Knowing your COGS is so important in any business, as it allows you to calculate your gross margin. Your gross margin tells you the amount of revenue you have left over to service other costs like operating expenses, debt, and reinvestment in your company. Unfortunately, this figure is not so simple in a SaaS environment. There are a number of variables involved in providing a service (software) which aren’t so easy to identify.

A very simple question to ask yourself when determining what to include in your COGS is the following:

If I don’t pay this expense, can I still offer my service to clients?

If you’re answer is no, then you should include that expense in your COGS.

In general, the following expenses are including in COGS for a SaaS:

-

Hosting costs

-

Employee costs associated with keeping the product running (ie. Support)

-

Third-party apps included in product delivery

In comparison, the expenses below should not be included in your COGS:

-

Commissions

-

Costs associated with upselling

-

Product development costs

-

Costs associated with internal operations

After calculating your COGS, your gross margin is calculated as follows:

Gross Margin (%) = Revenue – COGS

Revenue

The general benchmark in the SaaS community is that your gross margin should be between 80-90%. Or put in other words, your COGS should be about 10-20% of your revenue.

How does your SaaS stack up?